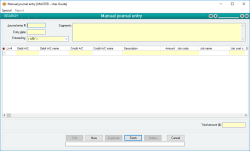

Manual journal entry

The Manual journal entry facility allows you to manually create journal entries directly affecting the balances of two or more accounts. A single journal entry can debit a nominated account by a certain value and credit a list of accounts by amounts that add up to that value. Alternatively, you can credit a single account and debit a list of accounts.

| Increase | Decrease | |

| Asset | Debit | Credit |

| Liability | Credit | Debit |

| Equity | Credit | Debit |

| Income | Credit | Debit |

| Expense | Debit | Credit |

Special actions available for users with Administrator permissions:

- None

Database rules:

- None

- Multiple account Transactions relating to a specific account can be performed in a single action

- You can choose to credit one account and debit a list, or debit one and credit a list

- Every journal entry can be linked to a Job code

Module: General ledger

Category: Manual journal entry

Activation: Main > General ledger > Manual journal entry

Form style: Multiple instance, WYSIWYS, SODA

Reference: Number, Read-only, WYSIWYS

This number uniquely identifies a Manual journal entry. The Journal entry # is automatically generated by the system after the first update and cannot be changed for the life of the Journal entry.

If a Journal entry is deleted, its Journal entry # will never be used again for another Journal entry.

This number is used as the resultant journal transactions' primary reference Ref #1

Reference: Date, Mandatory, QuickList, WYSIWYS

This represents the date for which the resultant Journal transactions will be performed. This date can be any date within the current extended financial year.

Reference: Select from list, Mandatory, HotEdit, WYSIWYS

This is the User ID of the user who created the Journal entry. This is automatically filled with the User ID of the current user and cannot be changed unless the user has Administrator permissions for Manual journal entries.

Reference: Memo, WYSIWYS, Expandable

This text is used for reference purposes only and contains details of the nature and reasons for the journal entry.

Reference: Account Field Type, QuickList

This is the account code of the account which will be debited by the nominated amount. If the Debit account is left empty, the Default Manual journal entry suspense account will be used in its place but will not actually appear on the screen, allowing you to simulate single-sided entries. The Debit A/C can only be left empty if a Credit A/C has been entered.

Reference: Account Field Type, QuickList

This is the account code of the account which will be credited by the nominated amount. If the Credit account is left empty, the Default Manual journal entry suspense account will be used in its place but will not actually appear on the screen, allowing you to simulate single-sided entries. The Credit A/C can only be left empty if a Debit A/C has been entered.

Reference: Text(255)

This is a description of the reason for the journal entry line. This is only used for reference purposes but should contain sufficient detail to give any user who views the transaction some information about why the account was adjusted.

Reference: Currency

This is the amount which will be transacted for the line. This amount can be positive or negative, and will be Debited to the Debit A/C and credited to the Credit A/C. Remember that if either of those accounts are not filled in, the Default Manual journal entry suspense account will be used.

Reference: Text(64), AutoComplete, QuickList, WYSIWYS

This is the Job code of the Jobs to which the Manual journal entry is attributed. This does not have to be filled in, but if it is it must represent a valid Job code.

Reference: AutoComplete

This is the cost centre related to the job that has been entered for this line. When allocated, job costing reports will show the DEBIT side entry of the transaction as a cost against the job and the nominated cost centre. The cost centre must be valid for this job, and you can press F3 to get a list of possible cost centres.

If you enter a cost centre that does not exist , it will be erased when you update the journal entry.

If you need to allocate multiple cost centres for the one job, you should create multiple journal entry lines and assign each one to a different job cost centre.

This is the date on which the DEBIT side entry of the transaction was reconciled using the Account reconciliation facility.

This is the date on which the CREDIT side entry of the transaction was reconciled using the Account reconciliation facility.

Reference: Currency, Read-only

This is the total Net amount of all Journal entry lines. A Journal entry line will always have a Net amount of $0 if both Debit and Credit accounts are entered. If either the Debit or Credit account is left empty, the Net amount for that line will be non-zero. The Net amount for the Journal entry must be $0 before the Journal entry can be updated.

Reference: Menu

This menu item allows you to set the journal entry to recur at specified periods if it is an entry that will likely recur.

Selecting this option will open the Recurring Journal entry form shown below and allows you to enter the following details.

Reference: Select from list

This option is only available for the Recurring Journal Entry form.

This option allows you to select one of two Journal entry types:

- Normal: This option means that the Recurring Journal Entry will function the same as all other recurring actions.

- Accrual: This option means that the journal will become a reversing journal that will happen once only, will recur on the 1st day of the next month, and will reverse the amounts of the original journal.

Reference: Read only

This field is read-only and displays the type and code to which the recurring action refers. The four types of recurring actions are:

- Journal entry: This recurring action is triggered from the Special menu of the Manual journal entries form and will display the Journal entry #.

- Sales invoice: This recurring action is triggered from the Special menu of the Sales invoice form and will display the Sales Invoice #.

- Supplier invoice: This recurring action is triggered from the Special menu of the Supplier invoice form and will display the Supplier Invoice #.

- Payment: This recurring action is triggered from the Special menu of the Payment form and will display the Payment #.

Reference: Read only

This field is read-only and displays Date for the selected record referenced in the Recurring details.

Reference: Number, Select from list

This field allows you to specify the number and unit by which you want the action to recur. The quantity field can be filled with any number up to 4 digits long. The unit field allows you to choose one of:

- Day(s)

- Month(s)

- Year(s)

Reference: Select from list

This field allows you to choose when in the given month the action will recur. This field is only available when Month(s) or Year(s) have been selected in the Recurs every... field. The options are:

- Day specified

- First day of the month

- First weekday of the month

- Last day of the month

- Last weekday of the month

Reference: Read only

This field is a read-only date displaying when the recurring action will next occur, as calculated by the selections in the Recurs every... and ...on the... fields.

Reference: Date

This field allows you to specify when you would like the recurring action to cease.

Note: If you input a date into this field that occurs before the Next recurrence date, this action will not recur.

Reference: Yes/No

This option is only available for the Recurring Journal Entry form.

This option allows you to specify that the amounts on the recurring journal entry will reverse the current journal entry. This is selected by default when the recurring entry type is set to Accrual.

Reference: Button

There are three buttons at the bottom of the Recurring action form, which are:

- Update: This will update your changes to the recurring action (either for a new entry or on an existing one).

- Delete: This will delete the existing recurring action.

- Cancel: This will cancel your changes.